Hong Kong’s Education Market – Trends and Opportunities

Hong Kong’s education market, renowned for its diversity and excellence, is undergoing new developments as the city seeks to transform itself into a regional education hub for training talent in the Greater Bay Area. At the same time, the city has fostered the growth of a vibrant private education sector covering e-learning, private tutoring, and edtech. We look at the latest trends and opportunities for investors within the sector, as well as the government’s role in shaping the market’s development.

Hong Kong has been the center for education in Asia for many decades, home to a diverse and international student body and some of the world’s best universities. The city is adept at cultivating multiple generations of high-skilled talent, and today continues to place a huge amount of importance on educating its youth.

The pandemic has accelerated trends toward digital and online learning, offering new growth opportunities for the host of new edtech and e-learning start-ups that support the city’s formal education system.

In addition, the government is seeking to turn the city into a “regional education hub” for higher education by deepening collaboration with institutions on the Chinese mainland and making it the center for learning and talent cultivation in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

In this article, we provide an overview of Hong Kong’s education market and discuss some of the new trends and opportunities arising within the sector.

Overview of Hong Kong’s education market

Hong Kong’s education landscape

Hong Kong’s education system was based largely upon the British system until an overhaul in 2012 led to the Diploma of Secondary Education (DSE) replacing the Hong Kong Certificate of Education Examination (HKCEE), the latter modeled after the UK’s GCSEs and the UK-based A-Levels.

Hong Kong has nine years of free compulsory education for children aged six to 15, covering six years of primary school and three years of junior secondary school. Kindergartens and childcare centers are only available for a fee and are normally provided for children aged three to six. All kindergartens in Hong Kong are therefore private and can be run as either a for-profit or non-profit institution. All kindergartens for children aged three to six are regulated by the Education Bureau, while kindergartens and childcare centers for children under the age of three are regulated by the Social Welfare Department.

Hong Kong’s Education Landscape in Figures

Number of kindergartens: 1,042

Enrolment: 155,956

Number of primary schools: 591

Enrolment: 348,994

Number of secondary schools: 508

Enrolment: 325,927

Number of international schools: 54

Number of higher education institutes: 22

Estimated government expenditure on education for the 2022/23 school year: HK$111.9 billion (US$14.3 billion)

Percentage of total estimated government expenditure: 13.8 percent

Note: The above figures are the latest available. The number of institutions is from the 2021/22 school year; enrolment figures are as of September 15, 2022 for the 2022/23 school year.

Source: Hong Kong Education Bureau

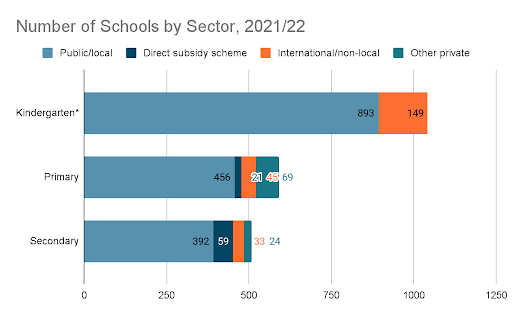

According to statistics from Hong Kong’s Education Bureau, in the 2021 to 2022 school year, there were a total of 1,042 registered kindergartens, 591 registered primary schools, and 508 registered secondary schools. Among the kindergartens, 16.7 percent were non-local, meaning they cater to non-Chinese-speaking children.

*Kindergartens are registered only as local/non-local. All kindergartens are privately run.

Note: Figures include only kindergartens and schools registered under the Hong Kong Education Bureau. Primary and secondary school figures do not include special schools.

Source: Hong Kong Education Bureau.

Meanwhile, among the registered primary schools, 19 percent were private, of which almost 40 percent were international. 11 percent of the registered secondary schools were private, of which 57.8 percent were international.

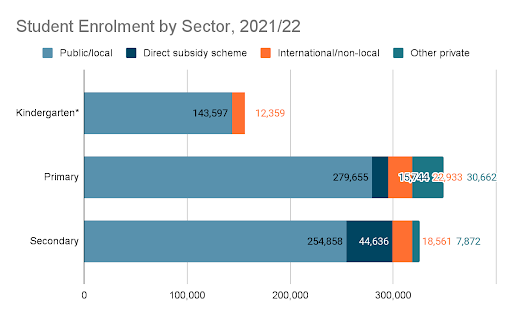

*Kindergartens are registered only as local/non-local. All kindergartens are privately run.

Note: Enrolment figures are as of September 15, 2021. Figures include only kindergartens and schools registered under the Hong Kong Education Bureau. Primary and secondary school figures do not include special schools.

Source: Hong Kong Education Bureau.

Hong Kong is also home to 22 degree-awarding higher education institutes, including four that are listed among the top 100 universities in the 2022 Times Higher Education rankings: the University of Hong Kong (30), Chinese University of Hong Kong (49), the Hong Kong University of Science and Technology (66), and Hong Kong Polytechnic University (91).

Growth drivers of Hong Kong’s education market

As a small city with limited natural resources and land area, talent is one of Hong Kong’s most important assets, and education is the backbone propping up the development of this key resource. Estimated government expenditure on education in the 2022/23 school year is HK$111.9 billion (US$14.3 billion), which amounts to 13.8 percent of the government’s estimated expenditure over that period.

On an individual level, Hong Kongers also place high value on education, as it is seen as one of the main drivers of social mobility. Many families are therefore willing to pay out of pocket for additional educational resources and services. For instance, although kindergartens are not free for children in Hong Kong, almost 100 percent of children aged three to five attended kindergartens in the 2021/22 school year, according to the Hong Kong Education Bureau. Hong Kong is also home to an extremely lucrative private tutoring industry, with parents spending thousands of dollars a month on extra-curricular learning in the form of private tutors, cram schools, and prep classes.

There has also been a trend of local Hong Kongers sending their children to private, fee-paying schools in Hong Kong, rather than local public schools, as there is a view that they provide higher quality learning than public schools.

The higher education industry is also an important sector in Hong Kong, home to some of the best universities in Asia. With most higher education institutions offering courses in English, the city also attracts thousands of international students every year.

Trends and opportunities in Hong Kong’s education market

International day schools

Hong Kong is a highly diverse city and home to people from many different nationalities, cultures, and ethnic backgrounds. As such, a range of international schools have been established to cater to the children of foreign workers as well as non-Chinese speaking families. There was a total of 54 international schools in Hong Kong in the 2021/22 school year, many of which provide both primary and secondary school grades.

The international schools also offer range of foreign curricula and degrees, including British, American, Japanese, and French curricula, the international baccalaureate (IB), Montessori, as well as religious-based and foreign language curricula. Notable international schools in the city include Harrow International School, Wycombe Abbey School, and Nord Anglia International School.

Hong Kong recently announced a series of new incentive policies to attract more international talent in the wake of the COVID-19 pandemic. The possible influx of more foreign workers will in turn have a positive impact on the foreign student intake at international schools.

Moreover, the government actively encourages the development of international schools in Hong Kong, “mainly to meet the demand for international school places from non-local families living in Hong Kong and families coming to Hong Kong for work or investment”, as written by the Education Bureau.

Higher education institutes

Hong Kong has long been a center for higher education in the region and is still home to some of the world’s top universities. The majority of Hong Kong’s universities offer English-language courses, facilitating cooperation with global institutions and greatly lowering the barrier of entry for international students, although enrolment of undergraduate and postgraduate foreign students (including mainland Chinese) is capped at 20 percent.

There has also been a marked uptick in the number of mainland Chinese students choosing to study at Hong Kong universities, especially as universities in western countries become less attractive following the COVID-19 pandemic.

The government is seeking to build upon the city’s excellent educational legacy by turning Hong Kong into a “regional education hub” through internationalization and diversification.

“The Government’s aim is to nurture talents for other industries and attract outstanding people from around the world, boosting Hong Kong’s competitiveness and facilitating the long term development of Hong Kong, Pearl River Delta region and the nation as a whole” – Hong Kong Education Bureau

The vision to develop Hong Kong’s higher education institutes ties into the city’s position within the GBA, which will see it foster talent for the development of key industries in the area. These are mostly surrounding the high-tech and emerging industries, in particular integrated circuits, advanced manufacturing, biopharmaceuticals, and more, but also fields such as finance, professional services, and trade, among others.

In terms of development trajectory, the government is seeking to develop Hong Kong’s education in science, technology, engineering, and mathematics (STEM) in order to create a highly skilled workforce that aligns with China’s overall development goals for technological and scientific development.

New talent schemes introduced in the GBA incentivize young skilled and sought-after talent from Hong Kong to work in the nine Guangdong cities of the GBA. Hong Kong’s higher education institutes have also taken steps to deepen cooperation with counterparts on the mainland through the establishment of research institutes. For instance, the Chinese University of Hong Kong established a mainland China campus in Shenzhen in 2012 and the Hong Kong Polytechnic University established the Shenzhen Research Institute to focus on R&D, technology transfer, and talent cultivation. The Education University of Hong Kong also began a scheme for undergraduates in the 2022/23 academic year to do work and internship placements in mainland GBA cities.

Online education and education technology

As is the case in many other places in the world, the COVID-19 pandemic has accelerated the uptake of e-learning and the edtech that facilitate online classes. Although in-person classes are likely to prevail post-COVID in the K-12 sector, many schools are still looking to integrate digital learning modes into their curricula and digitize their educational systems. This segment of the educational industry therefore still presents significant opportunities for vendors providing services and products, such as e-learning platforms and edtech consulting.

It is also important to note that e-learning and edtech have been developing in Hong Kong for many years prior to the pandemic, and now present one of the main growth areas in the city’s education sector. Hong Kong has fostered the rise of a range of e-learning and edtech start-ups covering a wide range of sectors, from K-12 to university to adult and vocational learning. Notable Hong Kong edtech and e-learning companies include italki, the online language-learning platform, Spredemy.com, which provides online tutoring for K-12 students, AfterShcool, an online DSE prep school, and Snapask, a homework help platform.

Private tutoring

The private tutoring industry is difficult to quantify due to the fact that many private tutors are informally employed and arranged privately, but it is clear that the industry is still highly lucrative. Unlike in mainland China, Hong Kong has not placed any restrictions on the development of the private tutoring industry, and it currently appears unlikely that it will do so.

In addition to the high value placed within Hong Kong society discussed above, private tutoring continues to be an important resource for families out of necessity. As explained in a research report written by Richard Eng, co-founder of Beacon College, a chain of cram schools in Hong Kong, a limited number of university spaces and minimum requirements for entrance for topics such as English, Chinese, mathematics, natural sciences, and geography, among others, has led to increased pressure on students and families to excel in school.

As with formal learning, private tutoring has also been swept up in the e-learning wave. Although this trend has been accelerated by the pandemic, which forced many people to experience online learning for the first time, the trend did not begin in 2020.

Richard Eng wrote in the report in 2019 that, due to Hong Kong’s declining birth rates and an aging population, tutoring institutes in Hong Kong are no longer able to rely on a growing student-age population for growth, and will instead have to focus on increasing the value of services and decreasing the cost of operations. This will include increasing the number of online classes and decreasing the number of in-person classes.

In addition to the trend toward online learning, the tutoring industry is also likely to follow the trend of many other sectors and begin placing more emphasis on personalization. This may include tailor-made courses and classes for individual students, as well as teachers-cum-influencers and social media replacing traditional marketing tactics.

The shift to online learning for private tutoring will naturally also come with an increased reliance on edtech and digital learning platforms, and the private tutoring sector will therefore likely develop closely alongside the edtech industry.

Support for educational institutions

There are generally no restrictions on foreign investment in Hong Kong, and foreign investors are permitted to set up wholly foreign-owned private schools and educational institutions.

QEF scheme

Launched in 1997, the Quality Education Fund (QEF) provides grants for “quality education projects” in K-12 schools and local companies helping to implement these projects. Funding is mostly given to projects that fall into five broad categories: projects for promoting effective learning, promoting all-round education, implementing school-based management, research projects exploring education issues, and application of IT. In addition, the QEF will normally set a range of “priority themes” for project funding each year, which will usually align with the government’s overall goals for education. For instance, for the 2020/21 school year, the priority themes included STEM education and information technology (IT) for education.

Companies that provide services and products for schools to implement these projects may be able to apply for grants from the QEF or benefit indirectly from schools that receive grants to implement projects and hire the company as a vendor.

The QEF also runs an e-learning support program for all primary and secondary schools by subsidizing laptops and internet support services for children who are unable to access these resources due to financial constraints.

NET scheme

The Education Bureau runs a Native-speaking English Teacher (NET) scheme to help attract native English teachers to public primary and secondary schools in Hong Kong. The Education Bureau assists schools by recruiting English teachers and appointing them to a public school and covering the teachers’ salaries and living costs.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at [email protected].

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.