Educational Development Stock: New Agreement With Usborne

Videologia/iStock via Getty Images

Since December, when we published Educational Development Corporation: Rapid Consultant Losses Don’t Augur Well, and February, when we published Educational Development Corp. And Bloated Inventories: Tulsa, We Have A Problem, revenue and earnings for Educational Development Corp. (NASDAQ:EDUC) have dissipated even more quickly than we were expecting. On July 6, EDUC released a shocking Q1’23 earnings report, with revenue down 43{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf} year-over-year, and net earnings down 94{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf}. A fifth straight quarterly decline in the number of average active Usborne Books & More (“UBAM”) consultants selling its wares to 32,200 (from 37,500 in Q4’22 and 55,100 in Q1’22) continued to decimate the company’s financial results.

To punctuate the degree to which EDUC’s latest financial results disappointed investors, consider that EDUC’s net revenues of $23.2 million was just over one-half of the $40.0 million consensus estimate, and EDUC’s EPS of $0.03 was a mere fraction of the $0.28 consensus estimate.

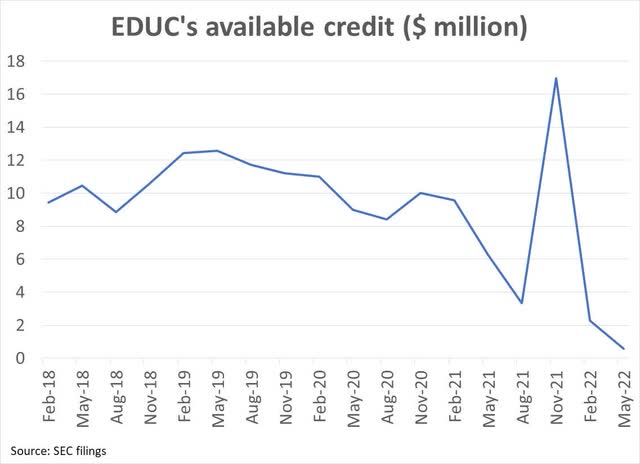

Over the past six months, cash flows from operations are now -$23.3 million, and debt on EDUC’s balance sheet has ballooned from $28.5 million to $46.8 million. Importantly, the slowdown in EDUC’s business has also contributed to a decline in the company’s available credit under its revolving line of credit, despite EDUC’s lender, MidFirst Bank, having agreed to multiple amendments to the company’s loan agreement over the last year:

EDUC’s available credit (EDUC’s SEC filings)

In recognition of the company’s precarious financial condition, EDUC suspended its quarterly dividend in May, a mere 18 months after increasing it.

Considering the fundamental deterioration of EDUC’s business in recent quarters, it is no surprise that EDUC’s stock has now declined roughly 55{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf} since we wrote our initial article, from $8.90 on December 3, 2021, to a two-year low of $3.94 on July 12, 2022.

However, we think this is just the beginning of what could be a fairly rapid decline to zero.

While our previous articles focused both on the overwhelming evidence supporting our assertion that EDUC’s UBAM segment was in the midst of a protracted period of fundamental decline, and on the impact that this decline was having on EDUC’s inventory balances, in this article we turn our attention to a much bigger problem facing the company – that being the changing relationship with its key supplier Usborne Publishing Limited (“Usborne”).

New Distribution Agreement With Usborne Publishing Limited

As a reminder, the vast majority of EDUC’s end sales are books and other products from UK-based Usborne, a market leader in children’s publishing and one of the best-known brands globally in children’s books. More than two-thirds of EDUC’s inventory purchases over the past five years were from Usborne, so to say that the distribution arrangements between EDUC and Usborne are important to EDUC’s business would be an understatement.

On May 19, 2022, after a year of steady decline in the UBAM segment, EDUC shockingly announced that it had signed a new Distribution Agreement with Usborne Publishing Limited, which replaced all outstanding agreements between the two companies. In EDUC’s press release announcing this news, EDUC disclosed that “following a six-month continuation of service period, [EDUC] will discontinue selling Usborne products through its Publishing division.” As well, EDUC “will no longer sell directly to Schools and Libraries.”

EDUC did, however, state in its press release that the “discontinuance of rights to sell Usborne products through the Publishing Division and direct to Schools and Libraries is not expected to have a material impact going forward [emphasis added] and for the last five years represented less than 10{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf} of net sales.”

Although the stock did fall 6{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf} the next day, we believe investors didn’t fully appreciate the significance of this announcement.

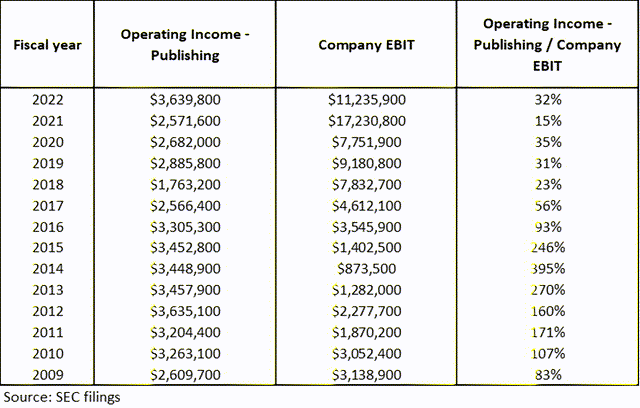

First, while the company is accurate in stating that EDUC’s Publishing segment represented less than 10{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf} of EDUC’s total net revenue over the past five years, that was only due to the unusually high level of the UBAM segment’s sales (driven largely by the COVID pandemic). Over the past decade, the Publishing segment’s annual net revenues have averaged over $10 million, and were at an all-time high of $13.3 million last year. As well, this segment’s operating margin has consistently been close to 30{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf}, well above that of EDUC’s UBAM segment. Considering EDUC has seen its UBAM consultant count shrink so rapidly, UBAM’s revenue and operating profit on a go-forward basis can be expected to be much lower than what they were in recent years. As a result, a significant decline in EDUC’s Publishing segment will be extremely material to the company’s top and bottom lines in our opinion:

Publishing segment’s importance (EDUC’s SEC filings)

As one can see, EDUC’s Publishing segment’s operating income has typically been a very significant contributor to the company’s overall earnings. EDUC will still get to sell products from its Kane Miller subsidiary as well as other vendors, so it’s not like the Publishing segment is disappearing; however, we believe it is fair to conclude that this segment’s annual operating income figures will be quite a bit lower than what they have been historically.

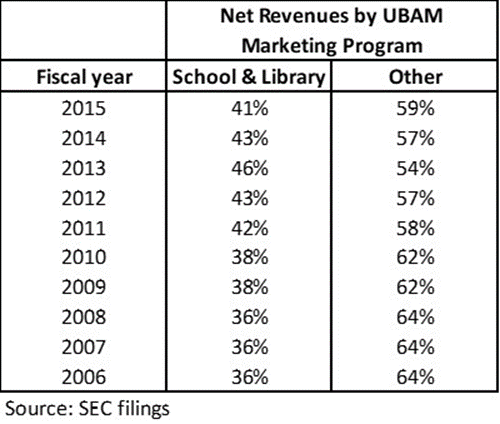

Furthermore, while School & Library (including book fairs) sales have similarly been depressed in recent years due to the pandemic, it is our belief that the removal of sales through that channel will have a material impact on the remaining UBAM segment’s revenue and operating profits in the future. Unfortunately, EDUC no longer discloses how much of its UBAM segment’s sales are to the School & Library channel. In the past though, they have disclosed this:

School & Library’s historical sales percentages (EDUC’s SEC filings)

On a go-forward basis, in an environment where active UBAM sales consultant numbers are most likely going to be dramatically lower than they have been in recent years, the impairment of both EDUC’s Publishing segment and its direct sales to schools and libraries will, in our opinion, have a very material impact on EDUC’s revenues, profitability and earnings. In addition, we believe it will likely have a further dampening effect on the ability of EDUC to attract and retain UBAM consultants, as we will explain next.

Welcome Back Amazon!

In our opinion, one of the most important consequences of EDUC losing the ability to sell Usborne books to retail and online stores could be that EDUC’s UBAM segment will once again find itself in an untenable situation of competing head-to-head with Amazon and other large online and bricks-and-mortar retailers.

To explain: A decade ago, then-CEO Mr. Randall White made the well-publicized (and correct) decision to stop selling Usborne books to Amazon and big-box discount retailers like Sam’s Club, Costco and Target. Randall had become very frustrated by the regular occurrence of EDUC’s UBAM sales consultants working hard to close a sale to a prospect only to have that prospect buy the books online at a fraction of the price. One December 2015 article about Mr. White’s decision explained the situation this way:

“White traces the current growth spurt to his highly publicized decision three years ago to stop selling books through Amazon. That decision, White explained, was made to assure retailers, as well as EDC’s sales consultants, that Amazon could not undercut the prices of EDC titles. The Amazon decision, White added, was also made with an eye toward stemming a nine-year decline in sales through its Usborne Books & More division, which uses independent sales consultants to sell its books through a combination of direct sales, home shows, book fairs, and Internet sales. In that regard, the move to stop selling to Amazon has proved to be a brilliant business decision.”

Another article contained a more succinct comment from Mr. White about the situation at the time: “We were selling more to Amazon but our business kept declining. I’m thinking, ‘What can I do here? This is crazy.’ You had to fix it, or you’re going to die anyway. [emphasis added]”

Well, now that Usborne has taken away EDUC’s rights to sell Usborne products through EDUC’s Publishing segment, that means that Usborne books will soon once again be able to be sold by Amazon and other online retailers. Except this time, EDUC will not benefit from those sales. And EDUC’s UBAM consultants will once again be in a position of losing sales to online retailers that will be able to offer better prices.

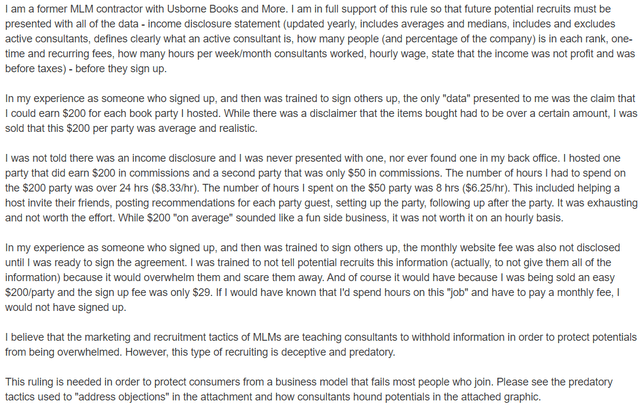

Many UBAM consultants already appear to be struggling to earn a reasonable amount of money selling the company’s products, per the company’s latest Disclosure Statement. A recent comment from a former UBAM consultant that was submitted to the Federal Trade Commission (“FTC”) in support of a proposed FTC rule to address deceptive or unfair marketing using earnings claims by multi-level marketing (“MLM”) organizations and others, provides a good example of these struggles:

Comment from former UBAM consultant (Federal Trade Commission)

In EDUC’s case, we believe the reintroduction of Amazon and other large discount retailers as direct competitors to the company’s UBAM salesforce will only make it much more difficult for UBAM consultants to earn a decent income, and will therefore accelerate the decline in active consultants that EDUC has been experiencing.

It Only Gets Worse…

While the information contained in EDUC’s May 19 press release immediately caused us to question the viability of the organization as an ongoing enterprise, it wasn’t until the company published its Q1 2023 10-Q filing with the SEC that we came to fully appreciate the magnitude of what has happened.

EDUC appended its 10-Q filing with the full text of the Distribution Agreement (the “DA”) between EDUC and Usborne Publishing Limited (minus certain redacted portions). The DA contains a number of absolute bombshells:

1. EDUC is completely losing the right to use the Usborne name

During a “Rebranding Period” that began on May 16, 2022 and that ends on a redacted date, EDUC must “[phase] out all use of the Restricted Brands.” Restricted Brand Names include “Usborne Books & More”, “Usborne Books and More” and “UBAM”.

While it not clear how long this rebranding period is (our guess is six months), what is clear is that EDUC will need to change the name of its Usborne Books & More business soon. We believe the magnitude of this development cannot be understated, as the entire value proposition of EDUC as a company, in our opinion, is dependent upon its association with Usborne, arguably the #1 children’s book publisher in the world.

What will EDUC rename its Usborne Books & More division during this Rebranding Period? Will it change to Kane Miller Books & More (KMBAM)? Whatever the decision is, we cannot see how this change will be anything but a massive negative for the company’s future.

2. EDUC is losing the myubam.com website

At the end of the Rebranding Period, EDUC and all of its UBAM consultants will lose access to the www.myubam.com website (and others). At that time, all of its consultants will need to fully cease the use of the Usborne name in any of its sales and marketing activities.

3. EDUC still has minimum annual purchase requirements

Despite choking on far too much inventory already, as was discussed in our February article, EDUC is required by the DA to order a certain volume of products from Usborne during the twelve months ending January 31, 2023, and for each twelve month period thereafter. If this minimum is not met, Usborne has the right to terminate the DA on 30 days’ written notice.

While EDUC declined to disclose what these minimum amounts are, the company did disclose in its 10-K that “In the past five years, we have exceeded the new annual minimum purchase commitments with Usborne.” It’s difficult to derive much of an idea about how much EDUC is required to buy from Usborne, but as EDUC has purchased almost $160 million worth of inventory from Usborne over EDUC’s last five fiscal years, we believe it is reasonable to assume that Usborne’s requirements are high enough to ensure that EDUC won’t be able to generate much cash in the near-term through a significant reduction of its bloated inventory.

The coup de grâce – a concerning USPTO filing

We have been unable to determine the thought process behind Usborne’s decision to impose a more restrictive set of distribution terms on EDUC. There are many potential reasons in our opinion; however, we believe it is possible that Usborne simply thinks it can do a lot better in the US without EDUC than with it.

One article written about the aforementioned Amazon decision by EDUC a decade ago included this comment from Peter Usborne, the founder and CEO of Usborne: “We weren’t involved in the decision. Randall just told me he’d done it. He quite likes a fight, and I think he was looking down the wrong end of a shotgun. It looked pretty grim for awhile, but now it seems he’s the wind in his sails.”

Perhaps Usborne believes that distributing its products through an organization that would arbitrarily cut off Amazon and other world-leading retailers is not the type of company with which it wants to be associated with going forward.

Whatever the reason(s), perhaps what we found digging through the U.S. Patent and Trademark Office (“USPTO”)’s website recently suggests something is afoot…

The DA between Usborne and EDUC not only requires EDUC to stop using the UBAM name, but to transfer to Usborne the www.myubam.com website. If neither EDUC nor EDUC’s sales consultants are permitted to use the UBAM name in the future, the myubam.com website becomes useless. So why would Usborne even want that website? Well, on June 29, 2022, Usborne, through its New York-based intellectual property legal advisors, submitted a trademark application to the USPTO for “UBAM.”

Could Usborne be getting prepared to sell their products through the US MLM channel themselves, like how they do in the UK through its Usborne Books at Home division? If they were, the UBAM brand is one that is already well-known in the US MLM space, and is undoubtedly one they would want to utilize. To be fair, the TA between EDUC and Usborne does state that “Usborne agrees, for the duration of this Agreement, not to appoint any other distributor nor itself to sell or distribute the Products through MLM Channels” so long as EDUC complies with the terms of the DA. However, we believe there will be opportunities in the future for Usborne to terminate the DA should they choose.

For instance, Clause 9.2 states that “[EDUC] agrees that it…shall ensure that none of its independent MLM sales consultants…use any of the Restricted Brand Names or any other name which…includes the name “Usborne” (including as part of their social media account names) at any time after the end of the Rebranding Period”, and Clause 9.6 states that “Any breach by [EDUC] of [Clause] 9.2…shall be deemed a material and irremediable breach of this Agreement which is incapable of remedy and which will entitle Usborne to terminate the Agreement…”. In other words, if Usborne ever finds out that an EDUC MLM sales consultant calls herself “The Usborne Books Lady of Tennessee” on her Facebook page, Usborne will be able to terminate the DA.

Risks To Our Thesis

We recognize that we have painted a pretty ugly picture of EDUC’s future. Although we currently believe EDUC’s stock price will continue to deteriorate and that EDUC will eventually declare bankruptcy, there are multiple risks to our thesis. These include the following:

- A deteriorating employment environment and/or inflationary pressures could re-energize EDUC’s to-be-renamed UBAM segment as more people look to supplement their household income by turning to the MLM model.

- EDUC could be more successful than we expect at filling the void created by the new Usborne DA, with dramatically increased Kane Miller book sales.

- EDUC could enter into distribution agreements with other vendors, which would increase the number of products it could sell in their two segments.

- Usborne could reverse their decision to reduce its dependence on EDUC in the US, and enter into a revised DA with EDUC that expands EDUC’s distribution rights.

Conclusion

Educational Development Corp. has seen a massive and rapid deterioration of its fundamentals since the peak of its business last year in the midst of the pandemic. The company’s stock price has followed the fundamentals and now sits 80{e4f787673fbda589a16c4acddca5ba6fa1cbf0bc0eb53f36e5f8309f6ee846cf} below its March 2021 high. However, we believe the situation with EDUC has transitioned from that of a company experiencing revenue and earnings declines to one whose near-term viability is questionable.

Not only will the recent changes in EDUC’s distributor agreement with its critically important vendor result in the elimination of very material pieces of EDUC’s business, but they potentially will inflict serious damage to the remaining MLM portion of the company. In addition, the USPTO trademark application by Usborne suggests that EDUC’s primary vendor could become EDUC’s primary competitor. Should that happen, we believe it’s game, set and match for EDUC, and shareholders will eventually be completely wiped out.